working capital turnover ratio ideal

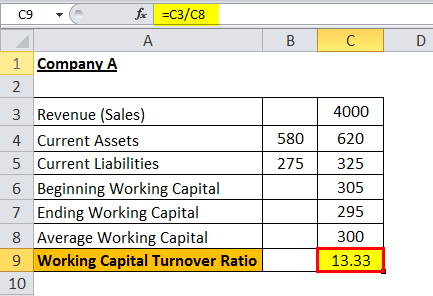

420000 60000. Working Capital Turnover Ratio Net SalesWorking Capital.

Working Capital Turnover Ratio Meaning Formula Calculation

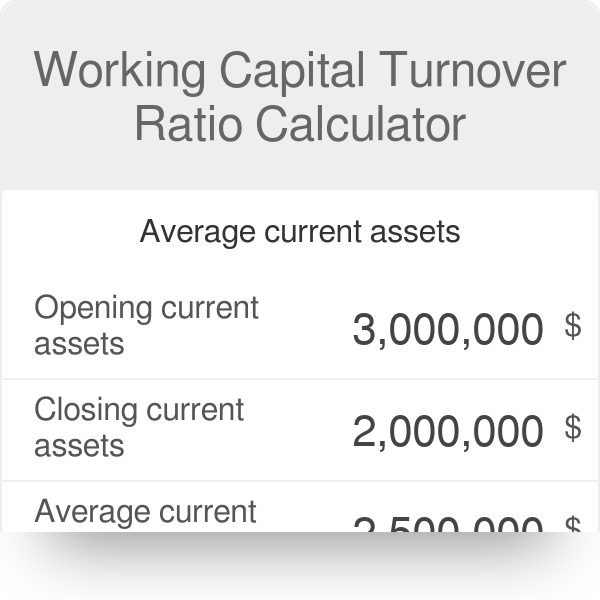

Average Working Capital Opening Working Capital Closing Working Capital 2.

. A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working. First lets calculate the average working capital. Net Sales Total Assets minus Total Liabilities In this way the amount of sales is directly related to the companys.

The working capital turnover ratio is thus 12000000 2000000 60. What is working capital. Working Capital Current Assets - Current Liabilities.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current. The working capital turnover ratio will be 1200000200000 6. Working Capital Turnover Ratio 288.

The Working Capital Turnover Ratio refers to the ratio of the Net sales and the average Working Capital of the company. 300000140000 214 Average working capital. The average working capital during that period was 2 million.

A low ratio indicates inefficient utilization of working capital during the. This means that for every 1 spent on the business it is providing net sales of 7. Working capital is to a business as wind is to a sailboat sure you might be able to drift along without it laboriously paddling to avoid the rocks but you really.

WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover. On the other hand if your ratio is above 2 then it might mean you are holding on to assets when you. Published October 12 2015.

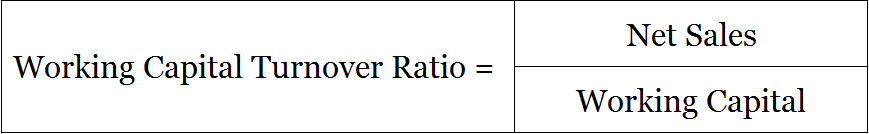

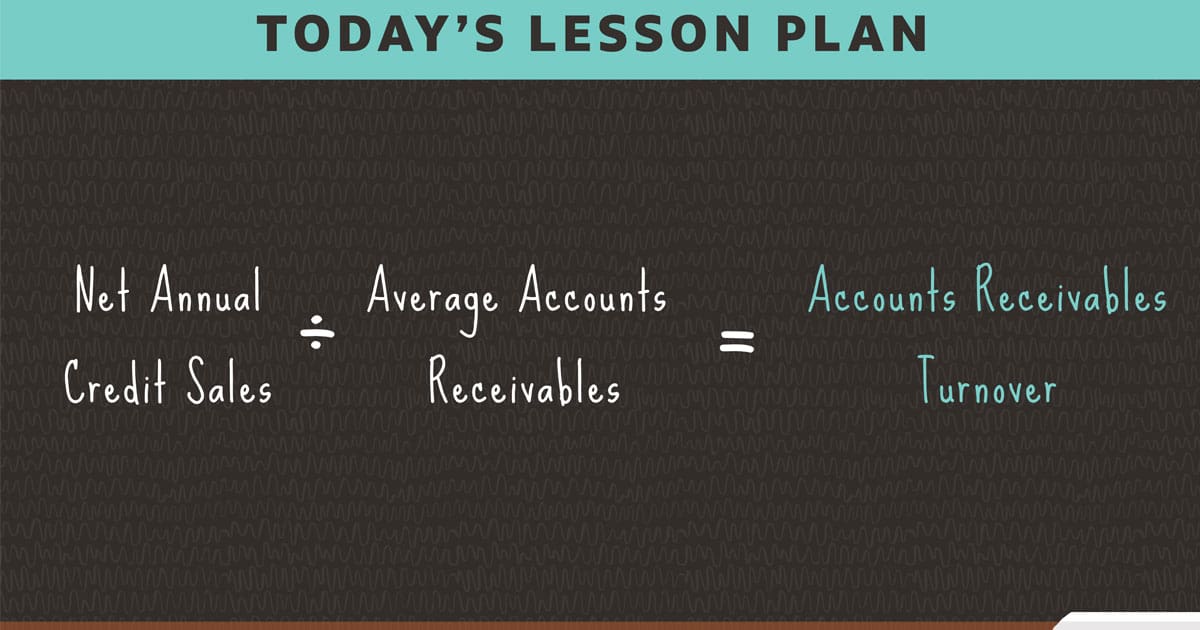

Working capital Turnover ratio Net Sales Working Capital. This concludes our article. Working Capital Turnover Ratio Net Annual Sales Working Capital.

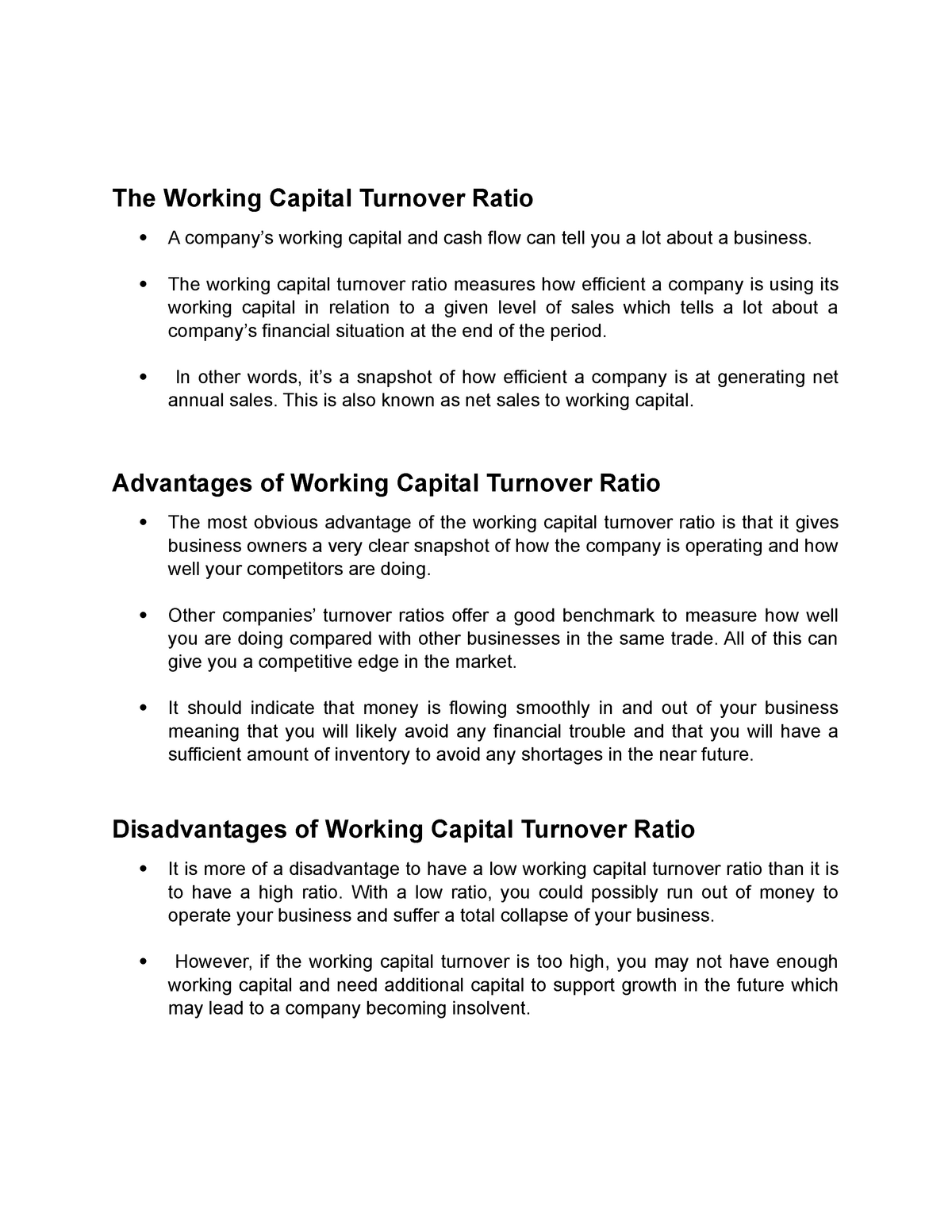

15000050000 31 or 31 or 3 Times. Compute working capital turnover ratio of Exide from the above information. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

What is the Working Capital Turnover Ratio. A higher working capital turnover ratio is better and indicates. Anywhere between 12 and 2 is considered an ideal range for the working capital ratio.

This shows that for every 1 unit of working capital employed the. Here the working capital formula is. Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a.

The working capital turnover ratio formula is as follows. Working capital turnover Net annual sales Working capital. Average Working Capital is the ideal figure to use for a more accurate result.

A companys working capital turnover ratio can be negative when a companys current liabilities exceed its current assets. This means that every dollar of working. It is a measurement of the efficiency with which the Working Capital is.

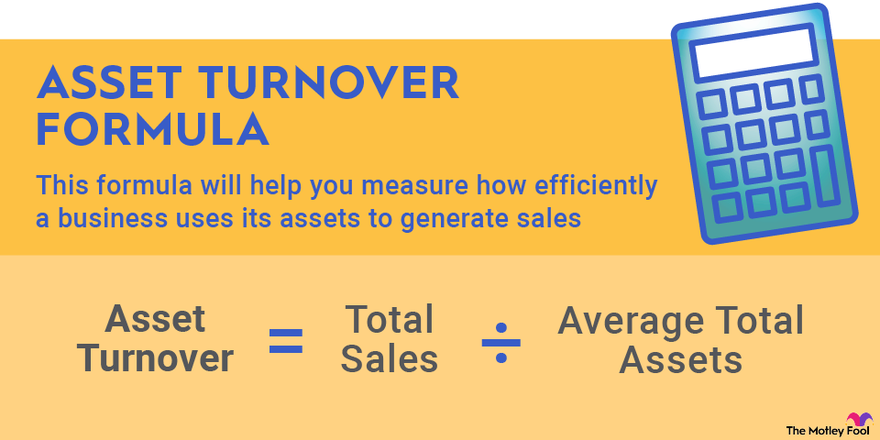

How To Calculate Asset Turnover Step By Step Tutorial

What Is Working Capital Turnover Ratio Accounting Capital

What Is The Working Capital Turnover Ratio Quora

Working Capital Turnover Ratio Calculator

What Is Working Capital Turnover Ratio Explained With Formula How To Increase It

Working Capital And Liquidity Explanation Accountingcoach

Working Capital Turnover What Is Nwc Turnover

What Is Capital Turnover Basics Definition Sendpulse

What Is Working Capital Turnover Ratio And How To Calculate Working Capital Turnover Ratio Youtube

Working Capital Turnover Efinancemanagement Com

Working Capital Formula How To Calculate Working Capital

Accounts Receivable Turnover Ratio Definition Formula Examples Netsuite

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software

What Is Asset Turnover The Motley Fool

Working Capital Turnover Ratio Double Entry Bookkeeping

The Working Capital Turnover Ratio Core Accounting Principles Statement Of Cash Flows Direct Studocu

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Meaning Formula Interpretation